Company News

Company Performance

Economic Factors

Industry Trends

Technical Analysis

Market Sentiment

Explore our top traded share CFDs from markets around the world, including US, UK and European stocks.

| US Stocks | UK Stocks | European Stocks |

| Alibaba | Aviva | Adidas |

| Alphabet | BP | Airbus |

| Amazon | EasyJet | BASF |

| Apple | HSBC | BNP Paribas |

| GlaxoSmithKline | Daimler | |

| Microsoft | Lloyds | Deutsche Bank |

| Netflix | Rio Tinto | Kering |

| Pfizer | Rolls-Royce Holdings | LVMH |

| Tesla | Tesco | Sanofi |

| Walt Disney Co. | Vodafone | Siemens |

Find out more about how to trade share CFDs with Upwin Markets or discover the right trading account type for you: standard, pro or swap-free trading account.

A share CFD mirrors the actual performance of an underlying stock. For example, the Apple share CFD follows the price of the Apple Inc. (AAPL) stock price.

When you invest in stocks, you pay the full price up-front to take some ownership of an asset and can only profit when the price of the stock increases. Conversely, when you trade share CFDs you’re simply trading the price movements, giving you the advantage of profiting from price movements in any direction.

And since share CFDs also allow you to apply leverage, you don’t need large amounts of capital to gain the benefits of trading some of the world’s biggest stocks.

A Contract for Difference (CFD) is one of the most popular forms of trading. It allows you to trade and profit from the price movements of an underlying instrument (such as stocks, forex, cryptocurrencies and commodities) without needing to physically own the asset.

You can trade CFDs in the same way as traditional forex trades, simply by picking an asset and speculating on the price direction, whether it is going up (going long) or going down (going short).

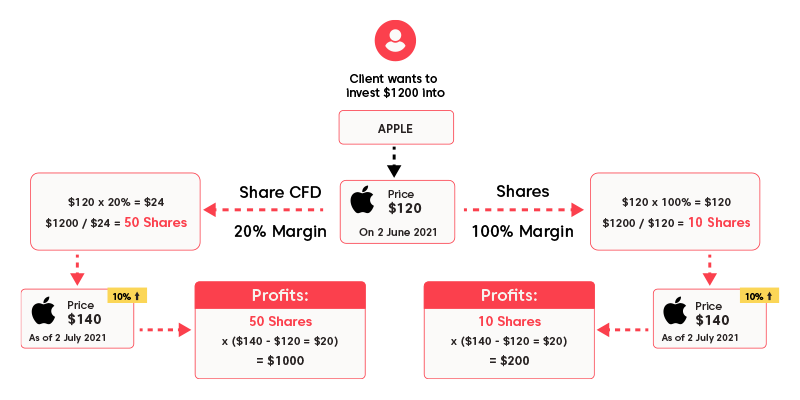

Let's look at two different examples of trading shares, using traditional share trading and share CFD trading.

It’s important to note that whilst margin trading can amplify returns, it can also amplify losses if the markets go against you.

Share CFDs and share trading both allow you to benefit from the rise and fall of a particular stock price, but share CFDs offer advantages that traditional share trading does not.

A key benefit is that share CFDs allow you to trade with leverage, meaning you only need to put up a small percentage of the full value of the trade in order to open the position. You also gain the freedom to go long or short, meaning you have the potential to profit whether the price of the underlying stock rises or falls. And because Share CFDs mirror all the rights of the underlying share, you also receive cash dividends.

| Commission | Trading hours (exchange time) | Minimum trade size | Minimum margin requirement | |

| US Stocks | $0 | 09:30 - 16:00 | 1 | 20% |

| UK Stocks | $0 | 08:00 - 16:30 | 100 | 20% |

| European Stocks | $0 | 09:00 - 17:30 | 1 | 20% |

Experience share CFD trading online the way it was meant to be – intuitive, fast and portable. When finding the right trading platform to trade stock CFDs, these are the ultimate tools to consider.

MetaTrader 4 is the smart choice for online traders everywhere who are looking for a trading edge. Simple for beginners and full of advanced functions for professionals, the MT4 platform helps you unlock unlimited trading possibilities.

Built to utilise Artificial Intelligence and Machine Learning, PsyQuation is a highly advanced trading analytics platform designed to reduce your trading mistakes and provide powerful performance analytics.

Autochartist continuously scans the market for customised trade opportunities, based on realtime pricing and your specific trade setups, then alerts you to potential trades.

At Upwin Markets, we offer a wide range of stocks that represent a large number of trading opportunities for our clients. Upwin Markets currently offers 50 share CFDs across the UK, US and European markets. For a complete overview of all share CFDs and their active time zones.

No, you do not own any part of the underlying asset. When you trade Share CFDs you are simply trading the price movements of the underlying asset.

No, Upwin Markets charges 0% commission for share CFDs.

All leveraged trading products, including CFDs, carry a degree of risk. We recommend using appropriate risk management strategies that suit your particular trading style and strategy.

Upwin Markets offers a comprehensive range of educational resources to help you better understand risk in trading and ways to manage it.

The stock market is moved by different factors when compared to forex trading. Stocks are particularly affected by news surrounding the underlying company's financial performance and trends in the broader world.

For example, the stock price of the NVIDIA technology company rose strongly because of a rise in the popularity of Bitcoin, which required NVIDIA’s graphics cards to mine them.